China Lowering Tarrifs on Imports

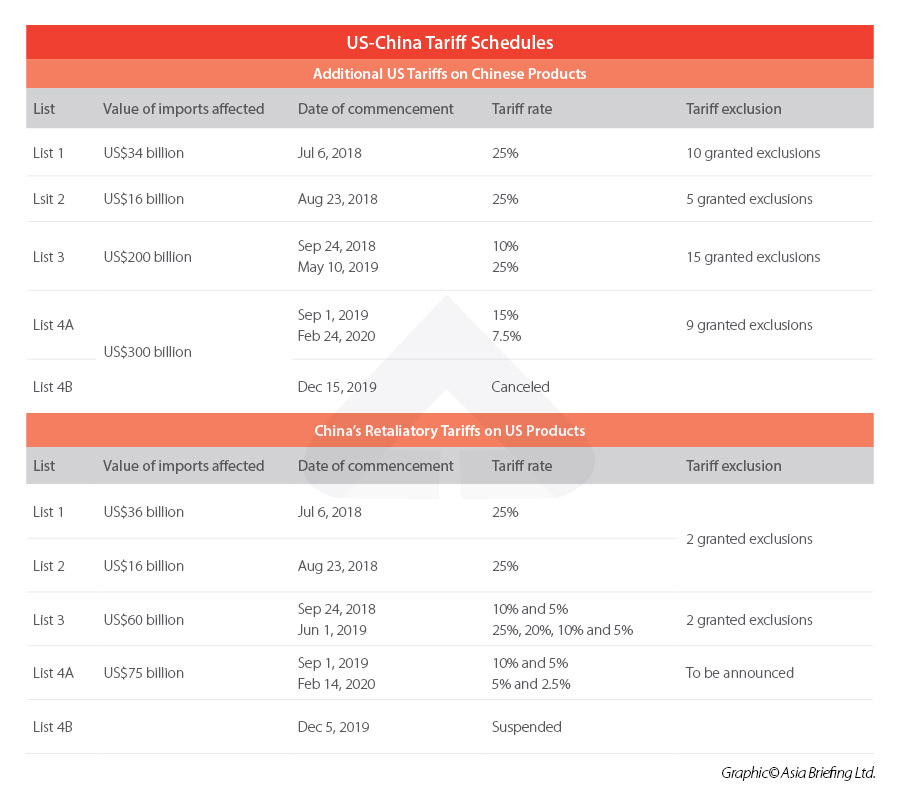

In 2018, United states President Donald Trump'due south administration imposed 4 rounds of boosted tariffs on approximately ii-third of Chinese imports to the US under Section 301. Despite hopes to the opposite, President Joe Biden has kept the tariffs in place since taking role in Jan 2021.

However, to avoid harm to American interests, US merchandise regime initiated a tariff exclusion process from June 2019 for Chinese products bailiwick to additional tariffs – US$34 billion (List 1), US$16 billion (List 2), United states$200 billion (List 3), and Us$120 billion (Listing 4A) trade actions. The Biden administration has likewise continued to extend tariff exemptions on these products equally they expired, based on public feedback.

Most recently, the US Merchandise Representative issued a notice in March 2022, extending tariff exemptions on a total of 352 products that had expired in 2019 and 2020.

In this article, we explicate what tariffs are currently in identify, including retaliatory tariffs by China on US products, and provide an overview of the latest extensions of tariff exemptions.

Current tariffs and tariff exemptions

The US has imposed tariffs on effectually United states$300 billion worth of Chinese goods for import. These products have been divided into four dissimilar lists – also known as tranches – with the first three lists approved in 2018 and the last listing approved in 2019.

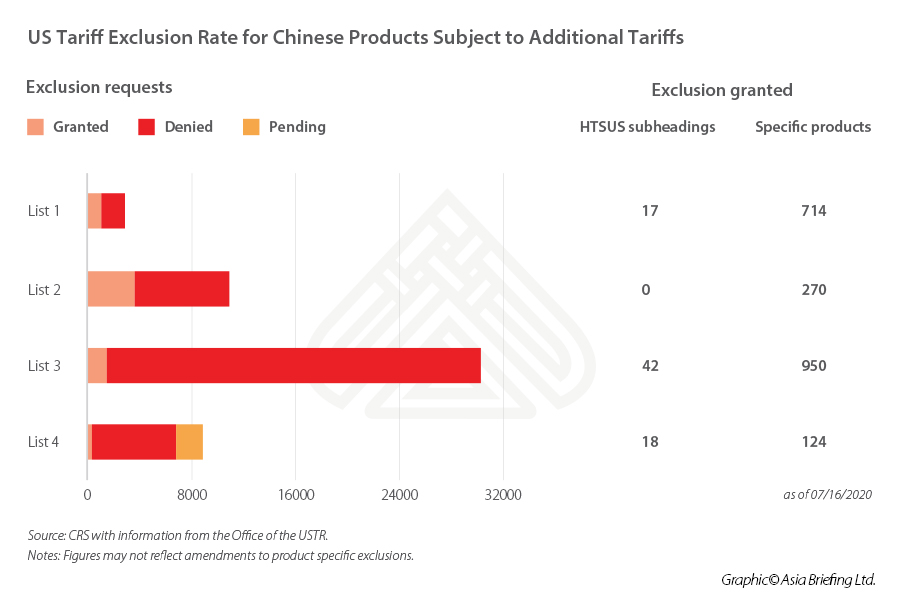

To date, the exclusion process has airtight for each of the iv lists of Chinese products and a total of 39 exemption lists accept been published by the USTR to benefit Chinese imports. The exemption charge per unit is not high.

While the exemption rates for Listing 1 and 2 are at 36 per centum, the exemption charge per unit for List 3, which covers more consumer and assembled appurtenances, is only 5 percent.

About of the exclusions were granted for a period of nether 1 twelvemonth from the date of their issuance, with the virtually contempo expiration taking effect on October ane, 2020.

However, while the US has imposed additional tariffs on Chinese imports in the course of the US-China trade wa r, beneath the headlines, the USTR has put in place a tariff exclusion process to exempt certain Chinese imports from additional tariffs.

Chinese goods in either one of the post-obit four Section 301 lists were allowed to apply for tariff exemption through the USTR.

- List 1 – US$34 billion worth of Chinese products, constructive from July 6, 2018;

- Listing 2 – Us$16 billion worth of Chinese products, constructive from Baronial 23, 2018;

- List 3 – US$200 billion worth of Chinese products, constructive from September 24, 2018; and

- List 4A – Usa$120 billion worth of Chinese products, effective from September 1, 2019. (List 4, including List 4A and 4B, originally covered US$300 billion worth of Chinese products, scheduled to be effective from September 1, 2019 and December fifteen, 2019. However, after the US and Cathay signed their Phase One Trade Agreement on January 15, 2020, the tariffs scheduled to take issue from December 15, 2019 were canceled.)

So far, the exclusion process for products on all iv lists have been completed and a total of 39 batches of exemptions have been granted.

However, statistics show that the US regime is not generous in granting tariff exclusions to avoid undermining the enforcement of Section 301. The exemption charge per unit for Lists 1 and ii are around 36 percent on average, while the exemption rate for List 3, which covers more consumer goods and assembled goods, was merely five percent.

Co-ordinate to Congressional Research Services (CRS), the public policy research institute of the US Congress, until Jan 31, 2020 – the USTR received a total of 52,746 exclusion requests, pertinent to all four trade deportment (lists). Of these, 45,942 (87 percent) requests accept been denied, 6,804 (xiii per centum) have been granted.

Exclusions for products needed to fight COVID-19

In March 20, 2020, the USTR announced it would work with the US Section of Wellness and Human being Services to "ensure that critical medicines and other essential medical products were not subject to additional Department 301 tariffs." Consequently, the The states did not impose tariffs on certain medical items, such as ventilators, oxygen masks, nebulizers, facemasks, surgical drapes, medical gowns, and gloves.

That same month, the USTR besides began soliciting opinions on whether it should remove more products on Section 301 and whether it should waive tariffs to help gainsay the COVID-19 pandemic. The USTR and then decided to extend 80 product exclusions that were fix to elapse at the end of 2020 and imposed new exclusions for ix additional medical care products. The exclusion on these 99 products was afterward extended in March 2021 until September 30, 2021.

With COVID-nineteen all the same spreading in the US in the latter half of 2021, the USTR initiated another round of public comment to ascertain whether these exclusions should be extended for some other half dozen months. On November 16, 2021, following consultation from the public, the USTR announced that the tariff exclusions would be extended for 6 months, until May 31, 2022.

Extension of exclusions on 352 products

In March 2022, the USTR announced that it would reinstate tariff exemptions on 352 Chinese products. The tariff exclusions on these products had expired in 2019 and 2020 and were reinstated after consultation with United states agencies and the public, which was initiated in October 2021. A total of 549 products were initially up for consideration for reinstatement of tariff exemptions, but just products that met sure criteria were ultimately chosen for the extended exclusions.

According to the notice on the exclusions posted on the USTR website, the public was invited to comment on whether the products or similar products can exist sourced from other countries, whether at that place have been any changes to the product supply chain or industry development, whether importers had made any try to source the production from elsewhere, and whether the production could exist produced in the United states of america.

The reinstatement of the tariff exemptions, therefore, suggests that the products tin can currently not be sourced or produced from countries other than Communist china. The list covers a wide range of products, including industrial chemicals and machinery, auto parts, textiles, consumer electronics, and foodstuffs.

The reinstated production exclusions will use retroactively from October 12, 2021, and terminate on December 31, 2022.

Archived: 39 batches of product exclusion granted

So far, 39 exclusion lists and 16 extensions for exclusions accept been released on the USTR website.

For List 1 (United states of america$34 billion trade action) – 10 batches of exclusions and six extensions for exclusions have been granted. Details can be constitute hither.

For Listing ii (U.s.$xvi billion trade action) – five batches of exclusions have been granted. Details can be found here.

For List three (US$200 billion merchandise activity) – fifteen batches of exclusions take been granted. Details can be found here.

For List 4A (The states$120 billion trade action) – nine batches of exclusions have been granted. Details can exist plant here.

Archived: Application process for tariff exclusion

The tariff exclusion process enabled interested persons in the U.s., including third parties (such as police firms, trade associations, and customs brokers) to submit requests for exemption from boosted duties at the USTR website https://exclusions.ustr.gov. Businesses would be asked to identify a specific product, the supporting information, and the rationale for the requested exclusion.

The USTR evaluates the exclusion application case-by-example and regularly updates the status of each pending asking on the Exclusions Portal at https://exclusions.ustr.gov/due south/PublicDocket . (You may search here for the status of your tariff-exclusion request).

The US government considers the following factors when processing tariff exemption requests:

- Whether the particular product is bachelor only from China, and whether the company made whatsoever efforts to source the product from not-Chinese suppliers.

- Whether the imposition of boosted duties (since September 2018) on the particular product has or will cause severe economical impairment to the requester or other US interests.

- Whether the item production is strategically important or related to 'Made in Red china 2025' or other Chinese industrial programs.

In addressing each factor, the requester needed to provide support for their assertions.

Any tariff exemption on the product(s), if granted, would be retroactive and be valid for one yr starting from the imposition of the additional duties.

Compared with Prc'due south own exemption procedures, the US tariff exclusion process additionally involves seeking opinions from other relevant interested parties.

The USTR likewise requires a more detailed description of the detail product, including its physical characteristics, function, application, principal use, and whatever other unique physical features that distinguish information technology from other products.

Editor'southward Note: This article was originally published on July 2, 2019 and was last updated on March 31, 2022. Run across hither for our commodity explaining Communist china'southward tariff exclusion process.

China Briefing is written and produced past Dezan Shira & Assembly. The practice assists strange investors into People's republic of china and has washed then since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Republic of indonesia, Singapore, Us, Federal republic of germany, Italy, India, and Russia, in addition to our trade research facilities along the Chugalug & Route Initiative.Nosotros also take partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, People's republic of bangladesh.

phillipslegreasing.blogspot.com

Source: https://www.china-briefing.com/news/us-tariff-exclusion-china-imports-eligibility-application-process/

0 Response to "China Lowering Tarrifs on Imports"

Post a Comment